Navigating the financial landscape of a small business requires a clear understanding of its different facets. Two critical, yet often distinct, areas are accounting and operational finance. While seemingly intertwined, their differing objectives can inadvertently lead to inefficiencies and duplicated efforts, especially within lean teams. This blog post will explore the core differences between accounting and operational finance, analyze how these distinctions create redundant workflows, and illustrate this with a common scenario faced by small businesses: processing vendor bills.

Accounting vs. Operational Finance: Different Sides of the Same Coin? While both deal with financial data, accounting and operational finance serve different primary purposes and have distinct objectives:

- Accounting: At its heart, accounting is about recording, classifying, and reporting financial transactions. Its primary objectives are historical accuracy, compliance with regulations (like GAAP or IFRS), and providing a clear financial picture for both internal (management accounting) and external stakeholders (financial accounting for investors, banks, and tax authorities). Accounting tells you what happened financially over a specific period. It focuses on accruals, ensuring revenue and expenses are recognized when earned or incurred, regardless of when cash changes hands. (Source: Aamalsoft, NetSuite)

- Operational Finance: This function is much more focused on the day-to-day financial health and future sustainability of the business. Operational finance is forward-looking, concentrating on managing cash flow, budgeting, forecasting, and making operational decisions based on financial insights. Its objective is to ensure the business has the necessary funds to operate, meet obligations, and strategically allocate resources for growth. Operational finance cares deeply about when cash comes in and goes out. (Source: Meaden & Moore)

In essence, accounting looks in the rearview mirror to report on the journey taken, while operational finance looks through the windshield and uses the dashboard to navigate the road ahead.

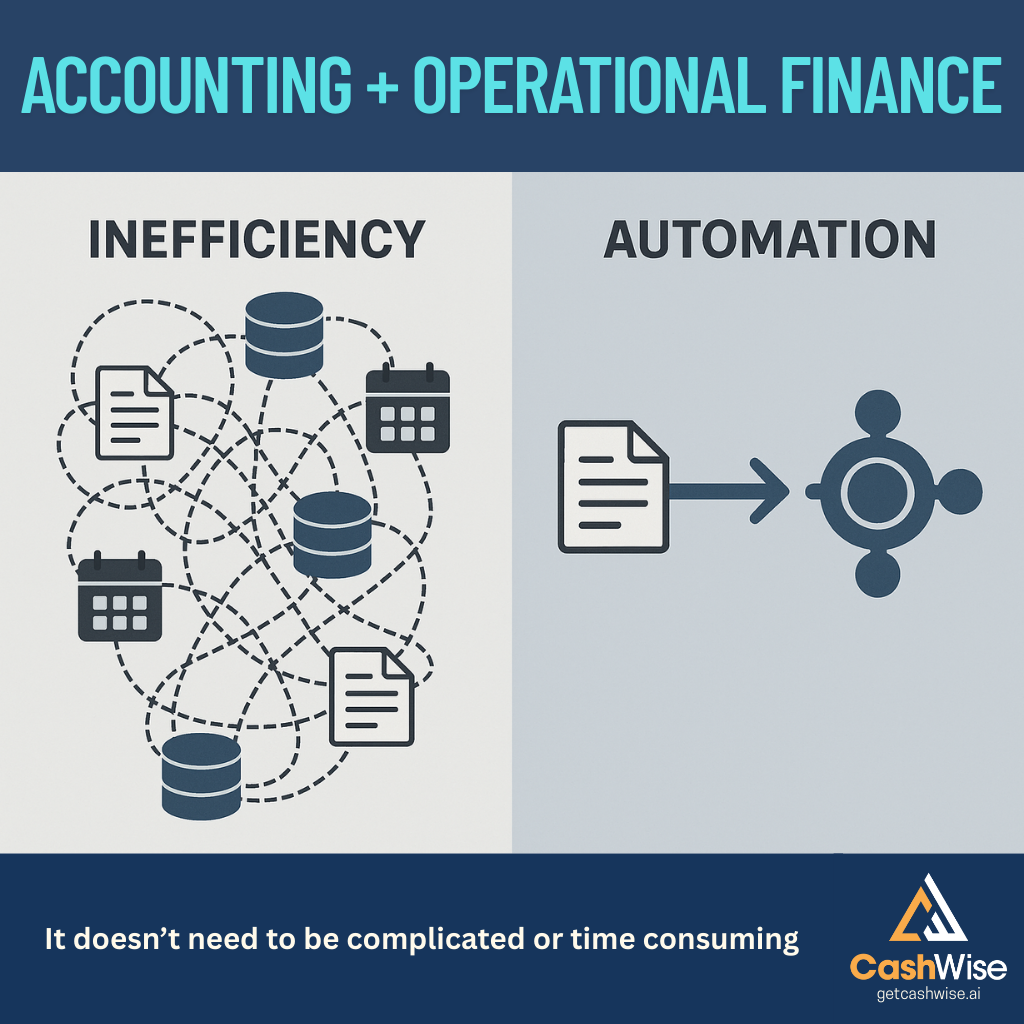

The Inevitable Overlap and Duplication The disconnect arises because both functions rely on the same underlying financial data – transactions like sales, purchases, expenses, and payments. However, their different perspectives and requirements mean this data often needs to be processed, analyzed, and managed differently, leading to significant overlap and duplication of effort. Accounting needs detailed records for accurate financial statements and tax filings. Operational finance needs real-time visibility into cash positions, upcoming payments, and potential cash shortfalls. Manual processes often struggle to efficiently serve both masters simultaneously.

A Bill Processing Scenario: The Duplication Gauntlet

Consider the process of receiving and paying a bill from a new vendor in a typical small business setting with manual or semi-manual systems. This scenario perfectly illustrates the potential for duplicated work:

- Bill Received & Reviewed: The bill arrives. Someone (perhaps operations or purchasing) reviews it for validity – ensuring the payee is correct, the amount matches the agreement, the goods/services were received, and the purpose is legitimate. This is an operational review.

- Initial Approval: A manager or owner reviews and approves the bill for payment. Another operational step, often involving physical signatures or emails.

- Entered into Accounting System: The bill is then passed to accounting. Here, it's entered into the accounting software. This entry is crucial for accounting purposes – recording the expense and liability (accounts payable) for accrual-based reporting. This doesn't necessarily trigger a payment.

- Vendor Setup (if new): The accounting or finance team needs to set up the new vendor in the accounting system and potentially in the separate banking or payment system. Duplication begins here – entering the same vendor details in two different systems.

- Payment System Entry: The approved bill now needs to be scheduled for payment. Someone enters the payment details into the online banking or payment platform. This is a core operational finance task focused on cash outflow management. This often involves re-entering payee details, amount, and invoice information.

- Payment Approval: The payment, once entered into the banking system, often requires another layer of review and approval within that system before it can be executed. Another operational finance control point.

- Payment Timing Decision: If the bill isn't due immediately, a decision is made about when to schedule the payment. This is a critical operational finance decision based on cash flow projections and vendor terms.

- If scheduled immediately for a future date, someone must ensure sufficient funds will be available in the account on that date – a cash management task.

- If deferred, the bill goes into a waiting queue, requiring a manual follow-up process to ensure it's picked up and processed closer to the due date. More operational tracking.

- Payment Execution & Reconciliation: Once the payment is made, it needs to be reconciled in both the banking system and subsequently posted or matched against the outstanding liability in the accounting system – requiring manual effort to ensure both systems reflect the same reality.

Imagine repeating these steps for dozens, hundreds, or even thousands of bills per month. Each step often involves manual data entry, verification, and communication between different people or departments, creating bottlenecks and increasing the risk of errors or delays. The accounting team enters the bill for accruals, the operational finance team re-enters much of the same data into a payment system, often with separate approval workflows. This is the tangible result of the different objectives – accounting needs the liability recorded accurately for reporting, while operational finance needs the payment scheduled and managed within the cash flow.

The Cost for Small Businesses

For small businesses with limited teams and resources, this duplication is more than just an inefficiency; it's a significant drain on time and productivity. Staff spend valuable hours on repetitive data entry and manual tracking instead of focusing on strategic financial analysis or other critical business functions. This can lead to delayed payments (damaging vendor relationships), missed early payment discounts, inaccurate cash flow forecasts, and difficulty in getting a real-time picture of the company's financial health.

Conclusion

While accounting and operational finance have distinct, vital roles, the traditional separation and reliance on manual processes inevitably lead to duplicated efforts. The example of bill processing clearly shows how data is handled multiple times for different purposes, consuming precious time and increasing operational risk for small businesses.

Streamline Your Finance Operations with CashWise

Recognizing the burden of these manual, duplicated processes, CashWise offers an AI-powered solution designed specifically for small businesses and their limited resources. CashWise bridges the gap between your accounting needs and operational finance requirements by automating many of the repetitive tasks that cause duplication.

Imagine a world where bills are automatically captured, data extracted, coded, routed for approval, and even scheduled for payment – all within a single platform. CashWise automates the initial data entry and review steps, ensuring accurate information is captured once and flows through the system for both accounting (accruals) and operational finance (payments, cash flow forecasting) needs. This eliminates the need for separate data entry in multiple systems and streamlines the entire procure-to-pay process.

By leveraging AI automation, CashWise frees up your valuable time and resources, allowing your small team to focus on what matters most: growing your business and making informed financial decisions.

Ready to eliminate duplication and streamline your financial operations?